Debt Ratio Definition, Components, Formula, Types, Pros & Cons

Новости

Новости  3 декабря 2021, 12:08

3 декабря 2021, 12:08  glady

glady

The long-term debt ratio focuses specifically on a company’s long-term debt (obligations due in more than a year) relative to its total assets or equity. The debt ratio is a measurement of how much of a company’s assets are financed by debt; in other words, its financial leverage. If the ratio is above 1, it shows that a company has more debts than assets, and may be at a greater risk of default. This can cause an inconsistency in the measurement of the debt-equity ratio because equity will usually be understated relative to debt where book values are used. Using market values for both debt and equity removes such inconsistencies and therefore provides a better reflection of the financial risk of an organization.

- This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets.

- It offers a comparison point to determine whether a company’s debt levels are higher or lower than those of its competitors.

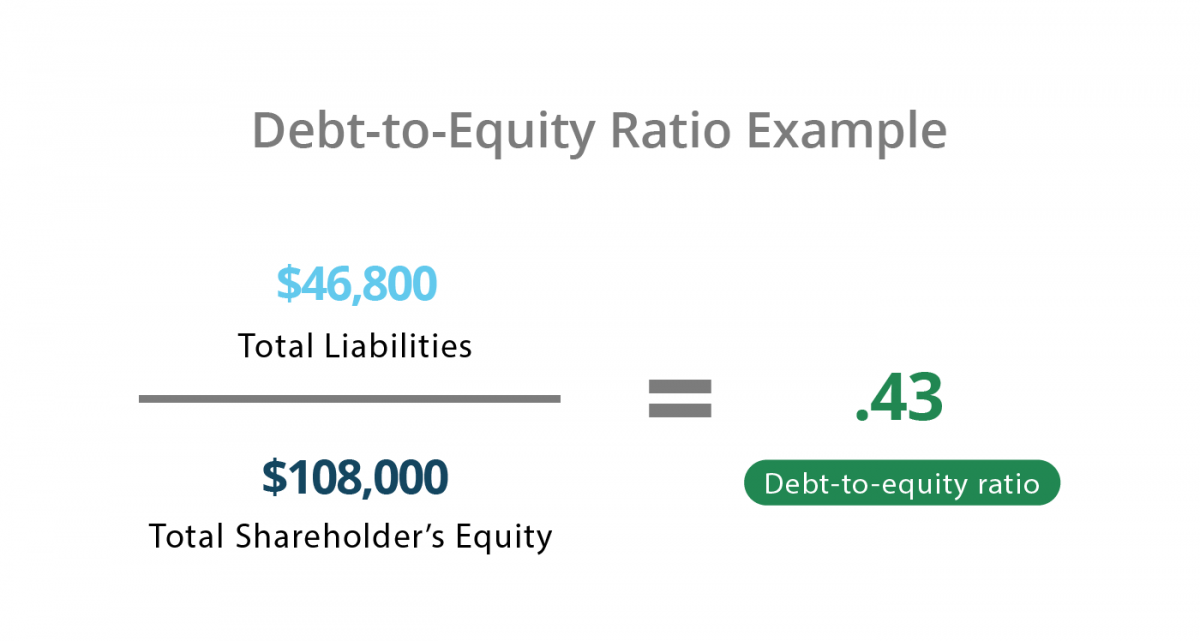

- The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity.

The Debt-to-Equity Ratio Formula

If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. Although debt financing is generally a cheaper way to finance a company’s operations, there comes a tipping point where equity financing becomes a cheaper and more attractive option. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each.

How do I calculate a company’s Debt Ratio?

Liabilities are items or money the company owes, such as mortgages, loans, etc. Finally, the debt-to-equity ratio does not take into account when a debt is due. A debt due in the near term could have an outsized effect on the debt-to-equity ratio.

How to Calculate the D/E Ratio in Excel

The composition of equity and debt and its influence on the value of the firm is much debated and also described in the Modigliani–Miller theorem. For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default. In all cases, D/E ratios should be considered relative to a company’s industry and growth stage. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity.

This means that the company can use this cash to pay off its debts or use it for other purposes. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures.

D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not. It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies.

The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts.

In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt.

For example, Nubank was backed by Berkshire Hathaway with a $650 million loan. A good D/E ratio also varies across industries since some companies require more debt to finance their operations than others. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income.

Меток нет

Меток нет

Похожие записи